Key Takeaways

- Homebuyer demand continues to decline amid high prices and rising mortgage rates.

- At the same time, homeowners fear surrendering a low mortgage rate and aren’t selling, which combined with the drop-off in demand, has frozen up the housing market.

- Single-family rentals (SFR) and build-to-rent communities (BTR) that offer premium amenities, affordability, and flexibility are helping to fill the housing gap, and also hold appeal for the lifestyle needs they meet.

- Amid economic uncertainty, resilient SFR/BTR tenant demand points to attractive short- and long-term real estate investment prospects for the asset class.

During the height of the COVID-19 pandemic, Americans seeking privacy and more space fled dense cities en masse, and began a suburban home-buying spree that rapidly drove up prices to record highs. Low interest rates allowed people to assume larger mortgages, contributing to the upward pricing spiral.

With home prices very high, housing affordability was dealt an additional significant blow as the Federal Reserve began combatting high inflation by aggressively hiking interest rates, which also pushed up mortgage rates. Home values have yet to decline significantly, with $379,100 reported as the median price for existing homes in October, a 6.6% increase from the prior year.1 Now, purchasing a home remains out of reach for many households.

How Mortgage Rates Froze the Housing Market

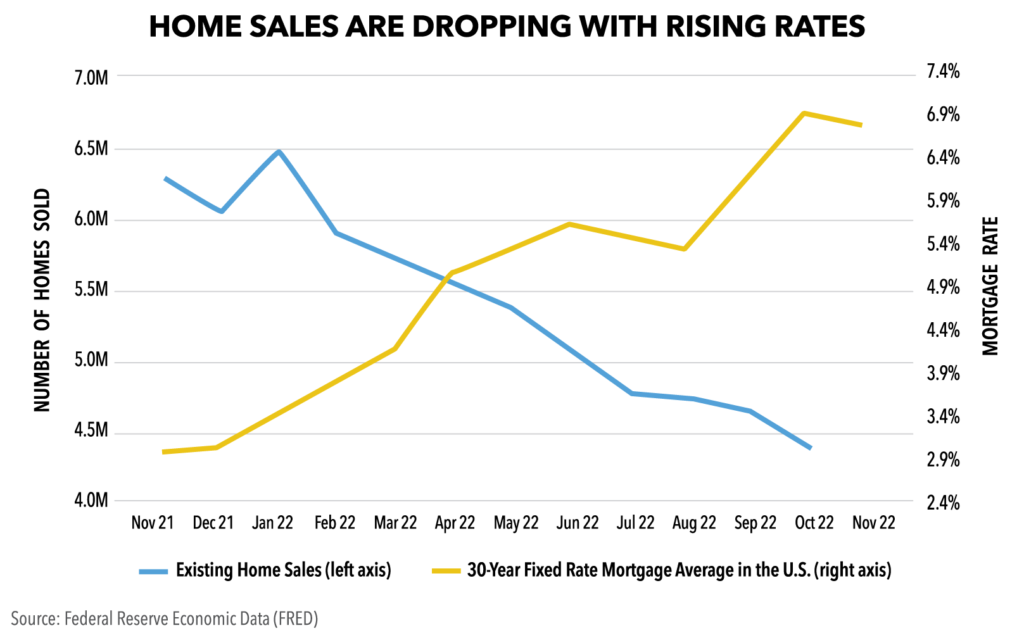

At the start of the year, the national average 30-year fixed mortgage rate for a home loan was 3.22%. Then, over six consecutive meetings, the Fed raised its benchmark interest rates 375 basis points, making 2022 the first time since the 1980s that the Fed has raised rates 3.75 percentage points in a single year. Average 30-year fixed mortgage rates doubled to 6.58% as a result.2

The rapid rise in interest rates created today’s seized-up housing market, in which homeowners with low-rate mortgages are staying put, and potential buyers either can’t afford to purchase a home or are waiting to see if prices drop. Reflecting this trend, existing home sales activity has fallen for nine consecutive months ending in October, with sales volumes down 28.4% from the same time last year.1 Additionally, mortgage application volumes are down nearly 70% compared to last year (as of the week ended November 18).3 Notably, many Millennials, who are in the traditional family forming years and potential first-time homebuyers, can’t afford to buy in the current environment, or are wary of doing so.4

Meanwhile, sellers aren’t placing their homes on the market because they fear surrendering a low interest rate on their existing home and replacing it with a much higher rate on a new one.5 At the same time, a national housing shortage that already existed before the pandemic has persisted, but the drop in buyer demand has caused homebuilders to pull back on new construction, exacerbating the shortage. The tight housing supply has helped keep prices high.6 Homebuilder confidence has declined for 11 consecutive months and is at its lowest level since April 2020.7 High costs aside, even buyers who can afford to purchase a home may opt to rent because of limited options in the marketplace.

Filling the Gap: Single-Family Rentals and Build-to-Rent Communities

The market dynamics creating affordability and housing supply challenges have driven strong demand for single-family rentals (SFR), making it the fastest growing sector of the housing market. SFR and build-to-rent (BTR) communities have been helping to meet the ongoing demand for single-family residences. The demand comes from disparate groups—potential homebuyers waiting out the market, people temporarily relocating, retirees, and others who want to live in a home, but with the flexibility of a rental. Distinct from affordability factors, generational trends among Millennials include a preference for renting amenity-rich homes, long-term, over buying.

Many others are also choosing to rent homes in SFR/BTR communities for lifestyle reasons, enjoying the benefits of a single-family home, without the financial commitment and maintenance headaches. The most attractive professionally managed properties drawing tenants offer features that include:

- High-quality suburban neighborhoods in growing secondary cities with access to downtown areas, employment hubs, and entertainment and recreation options.

- Newly built or renovated homes with the latest designs, and premium amenities, appliances, and fixtures.

- Professional management to maintain common areas and yards, and perform repairs.

- Flexible lease terms that allow a household to relocate relatively quickly.

The housing market may remain under pressure for some time, with continued economic turbulence expected over the coming year. Economists see a 63% probability of a recession in the next 12 months.8 Additionally, Fed officials have hinted at more rate hikes ahead, albeit at a slower pace, which may further push up mortgage rates.9

Through the predicted downturn, SFR/BTR communities are well positioned to continue filling the housing gap. Additionally, SFR/BTR offers enduring, long-term appeal from a lifestyle perspective for those who can afford to buy but prefer the flexibility of renting. For real estate investors, these market and lifestyle trends suggest a long and attractive runway ahead for SFR/BTR properties.

- “Existing-Home Sales Slumped 5.9% in October,” National Association of Realtors, published on November 18, 2022.

- “Primary Mortgage Market Survey,” Mortgage Rates, Freddie Mac, released on November 23, 2022.

- “MBA Mortgage Applications Survey,” Moody’s Analytics, published on November 23, 2022.

- Tom Huddleston Jr., “Millennials and Gen Zers do want to buy homes—they just can’t afford it, even as adults,” CNBC, published on June 12, 2022.

- Jeff Ostrowski, “How low mortgage rates led to today’s ‘seller’s strike’,” Bankrate,

published on October 25, 2022. - Jeffery Hayward, “U.S. Housing Shortage: Everything, Everywhere, All at Once,” Fannie Mae, published on October 31, 2022.

- “NAHB/Wells Fargo Housing Market Index (HMI),” National Association of Home Builders, released on November 16, 2022.

- Anthony DeBarros, Harriet Torry, “Economists Now Expect a Recession, Job Losses by Next Year,” The Wall Street Journal, published on October 16, 2022.

- Christopher Rugaber, “Fed official suggests substantial rate hikes may be needed,” The Associated Press, November 17, 2022.