So you are thinking about investing in commercial real estate through crowdfunding. You have some choices ahead of you — and not just what market or what type of property you want to invest in. There’s also the decision of whether to invest it either debt or equity. Let’s take a closer took at each investment type, and how the strategies differ.

The Basics

With a debt-based investment, you are lending money to the property owner and your return comes from interest paid on the loan.

With an equity-based investment, you are buying an ownership interest in a property and your return comes from the asset’s cash flow and sale/refinancing proceeds.

Debt-based investments typically have a fixed return, while the return on an equity-based investment will vary based on the net profit of the property. As such, there are usually greater potential returns on equity-based investments. That being said, you are more likely to come across a debt-based investment.

Debt-based real estate crowdfunding is slightly more common than equity-based crowdfunding in North America. According to Massolution, debt-based real estate crowdfunding comprised roughly 60% of the total $414 million funded in 2014. Equity-based crowdfunding represented 40%. Equity-based crowdfunding, however, is much more popular in North American than the rest of the world. In 2014, North America represented 88% of the total equity raised through real estate crowdfunding across the globe.

The Capital Stack

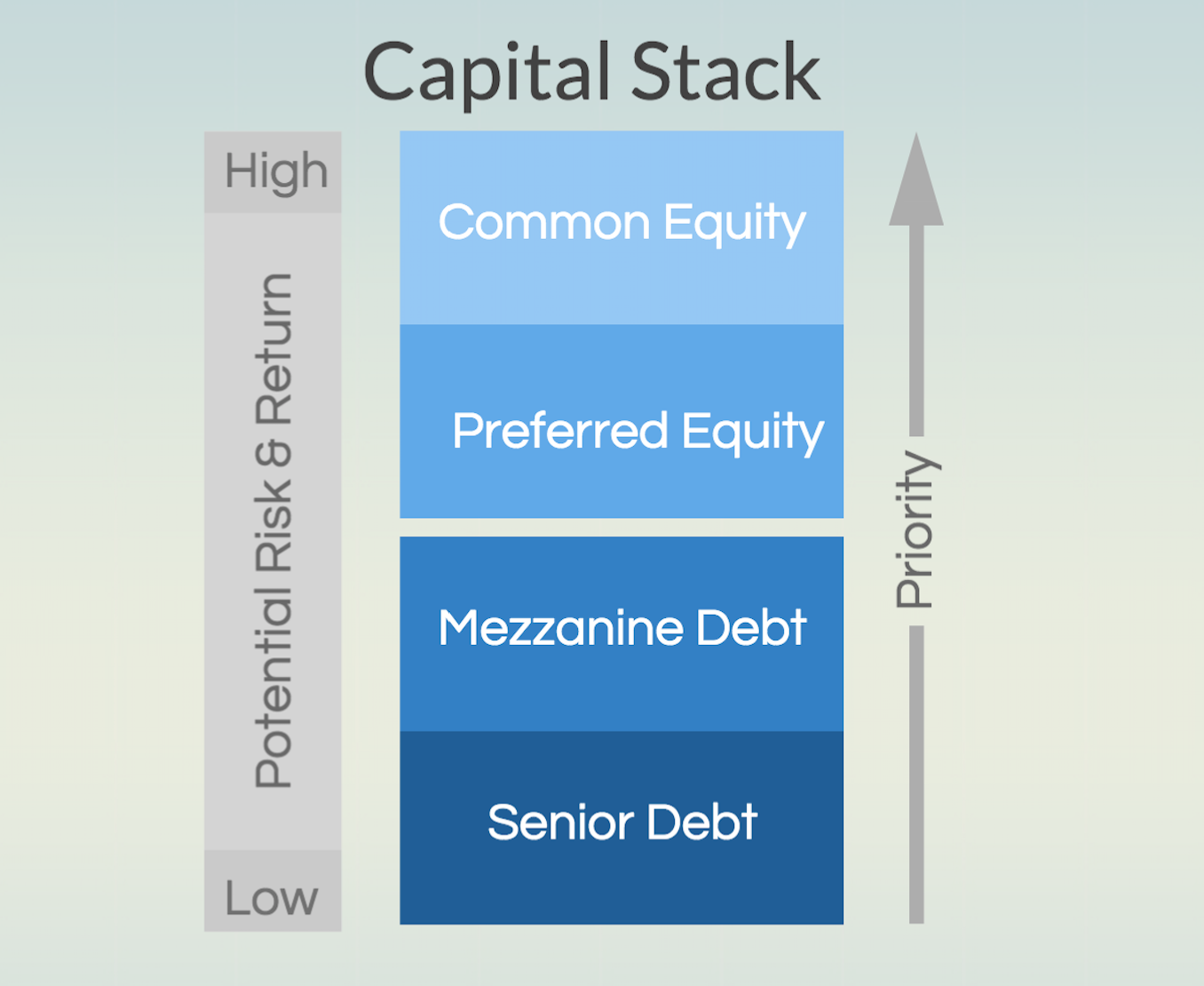

The capital stack is a valuable tool to help better understand the differences between debt-based and equity-based crowdfunding investments. The capital stack is a visualization of the different layers of financing that comprises a given deal, and can be used to help highlight the risk/reward relationships between debt and equity investments.

Add up each layer in the stack, and you end up with the total capitalization of the project — that’s the purchase price plus all additional equity being used to execute a business plan. Higher positions in the stack can be expected to earn higher returns. This comes along with the expectation of higher risk, as the lower portions of capital stack take priority in terms of being paid back first.

For example, in the event of a sale or refinance, the senior debt will be paid off before the mezzanine debt. Next the preferred equity will be paid back, followed by the common equity.

While senior debt investors in the capital stack above have the lowest risk profile, they would also earn the lowest returns (usually the loan’s interest rate minus some fees). There is no chance for debt investors to earn returns off of a property’s appreciation, whereas equity investors have an uncapped rate of return that includes a portion of the cash flow and sale/refinancing proceeds.

Note that the example above is a simplified version of a potential capital stack, as there is no limit on the number of potential slices.

A Summary of Debt and Equity Investment Structures

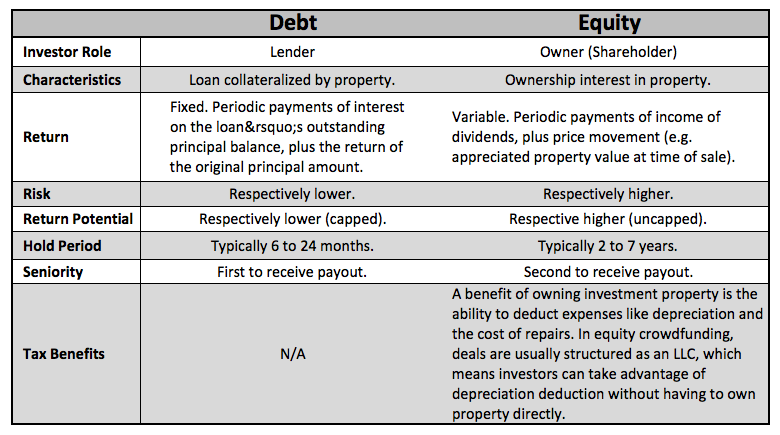

The table below highlights the main differences between debt-based and equity-based crowdfunding investments. Note that investments structures will vary on a case-by-case basis.

Make sure to understand the specific investment terms before participating and any crowdfunding opportunity.