The Federal Reserve’s interest rate hikes this year have had many impacts across various financial markets. In the real estate industry, mortgage rates are rising as a direct impact of rate increases, making commercial property deals more expensive to finance, or limiting the amount of debt projects can support.

During periods of rising interest rates, there are a few tools investors can employ to potentially hedge increasing debt service for mortgage loans. Borrowers of variable interest rate loans (also referred to as “floating interest rate loans”) can utilize an interest rate cap to set a limit on their interest rate for a period of time, or they may execute an interest rate swap and exchange the variable interest rate with a fixed rate.

While purchasing an interest rate cap or swap can be a hedge against rising interest rates, it does come with risks. Investors should know the advantages and potential downsides to these financial tools.

Interest Rate Caps

Interest rates on commercial real estate loans are comprised of a nominal spread (the rate above what the lender charges for additional risk) plus an index, such as the Secured Overnight Financing Rate (SOFR). For floating interest rate loans, the spread is fixed, and the index is variable, which is why rates can move up or down.

If a borrower projects that rates will continue to rise during the term of their loan, they can purchase an interest rate cap from a provider to limit the interest rate for a certain term. Sometimes lenders will require borrowers to purchase an interest rate cap on a floating rate loan to limit the risk of repayment in a rising interest rate environment.

The rate cap will be used to set a limit on the interest a borrower will be required to pay if the index portion of the interest rate rises above a certain rate, known as the “strike rate.” The interest rate cap provider will price the cost of the interest rate cap based on a forward curve, which is a projection of an index’s future rate.

As SOFR replaced the London Interbank Offered Rate (LIBOR) as a widely used index benchmark rate, an interest rate cap price could be based on the SOFR forward curve.

With an interest rate cap in place, the borrower will continue to make payments on the variable interest rate, which can continue to move up or down, but if it surpasses the strike rate, the interest rate cap provider covers the excess interest expense.

The borrower’s interest rate cap execution could be considered a success if the cost to purchase the interest rate cap was less than the cost of interest payments when the rate rose above the strike rate. If interest rates do not rise above the strike rate in an amount that exceeds the cost of the cap, then the borrower would have needlessly used capital to purchase the cap.

Example:

- A borrower obtains a $15 million loan with a 3-year term and an interest rate of a 2.50% spread plus 30-Day SOFR of 1.73%, thus a total interest rate at closing of 4.23%.

- The borrower purchases an interest rate cap on 30-Day SOFR at a strike rate of 2.75% from a cap provider, limiting their interest rate at 5.25%.

- Three months later, interest rates stay the same, therefore the borrower continues to pay the 4.23% floating interest rate to the lender.

- An additional three months later 30-Day SOFR increases to 3.0%. The borrower’s total interest owed to the lender is 5.50% (the spread of 2.50% + the 30-Day SOFR 3.0%). The borrower pays all the interest owed up to 5.25% (the 2.50% spread + 2.75% 30-Day SOFR cap).

- The interest rate cap provider pays the remaining 0.25% interest owed to the lender.

Interest Rate Swaps

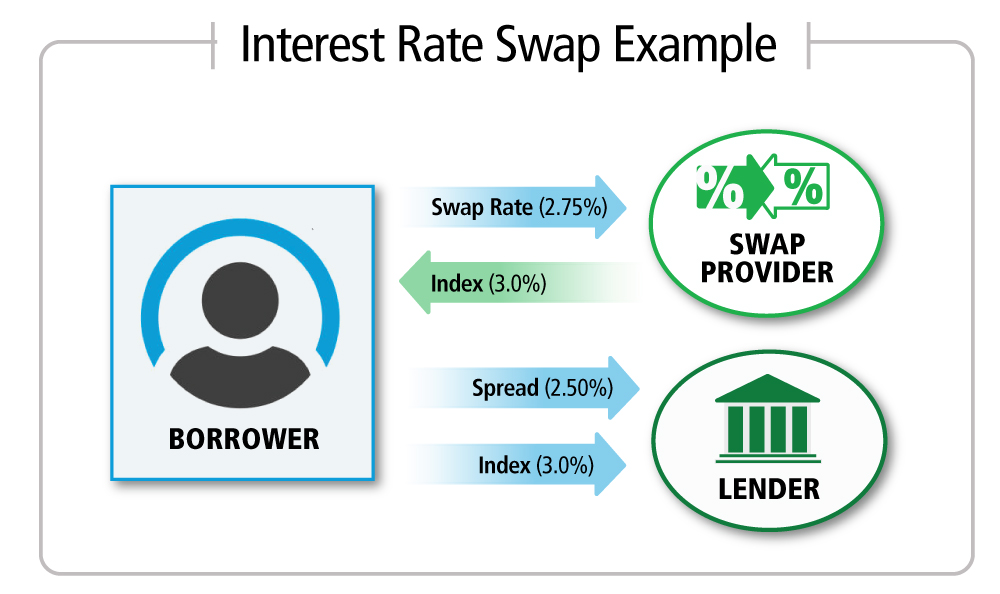

Another option for a borrower with a floating interest rate loan to hedge against rising rates, could be to purchase an interest rate swap from a third-party provider. The provider will take on the responsibility of making the floating rate payments and gives the borrower a fixed interest rate in exchange.

With this financial tool, the borrower is hedging interest rates rising above the fixed swap rate over a certain term. Using the interest rate swap can result in the borrower maintaining lower payments and saving capital if interest rates do in fact rise above that fixed rate. Unlike an interest rate cap, however, the borrower could lose the benefit of decreasing interest rates if rates begin to fall after the swap is executed since they will have a fixed rate. Additionally, there could be a risk of prepayment penalty or an early termination fee if the borrower decides to prepay the loan before a specified date.

Example:

- A borrower obtains a $15 million floating interest rate loan with a 3-year term. The floating interest rate is currently comprised of a 2.50% spread plus 30-Day SOFR at 1.73%, thus a total interest rate at closing of 4.23%.

- The borrower anticipates that interest rates will increase over the term and wants a fixed interest rate.

- The borrower purchases an interest rate swap from a provider at a 30-Day SOFR of 2.75%.

- The borrower pays the floating interest rate plus spread (4.23%) to a lender and the swap rate from the provider (2.75%).

- The provider rebates the 30-Day SOFR of 1.73% on the floating interest rate.

- The result is the borrower paid a total interest rate of 5.25% (2.75% + 2.50%) while the provider paid the index (1.73%) to the borrower and received the swap rate (2.75%).

- Should 30-Day SOFR rise to 3.0% in three months, the floating interest rate loan payment the borrower owes to the lender will become 5.50% (2.50% spread + 3.0% 30-Day SOFR).

- However, since the borrower will pay the swap rate (2.75%) to the provider and receive the index rate (3.0%) from the provider, the borrower’s effective rate will remain 5.25%, resulting in the borrower realizing 0.25% in savings.

Interest rate caps and swaps may be beneficial to borrowers if rates continue to rise as they theorize, however, swaps and caps may pose a risk if the rising interest rate environment is temporary, and rates decline instead. Additionally, as cap and swap providers are undertaking financial risk, the cost to purchase these instruments may become onerous to borrowers. While in certain cases these tools maybe required by lenders to limit the risk that borrowers will not be able to cover high interest payments as rates increase, sponsors may not need to purchase these financial tools to hedge rate hikes if they properly budget or reserve capital for increased costs from higher interest rates.