Single-family rentals (SFRs) have become one of the most active segments of the real estate industry due to a confluence of socioeconomic trends and high interest from institutional investors. While the COVID-19 pandemic disrupted other industries and the U.S. economy overall, the multifamily real estate segment showed its resiliency. However, the shining star within the broader multifamily space is the SFR market, which continues to gain steam.

With housing prices at all-time highs, and people in need of more affordable homes, demand for single-family rentals has grown substantially, and large investors are now entering the SFR market at breakneck pace — even though the asset class has existed for many decades.

Institutions invested heavily in SFRs in 2020 to the tune of nearly $5 billion, according to CBRE. Also, according to a Trepp report, in 2020 there was more than $8.3 billion in commercial mortgage-backed securities issued for SFR properties, doubling the amount issued in 2019.

The Early Years of Single-Family Rentals

Single-family rentals can be one-unit detached homes, townhomes, or even row homes acquired in scattered sites or in contiguous communities. They are usually characterized by private yards and driveways and are typically located in suburban areas.

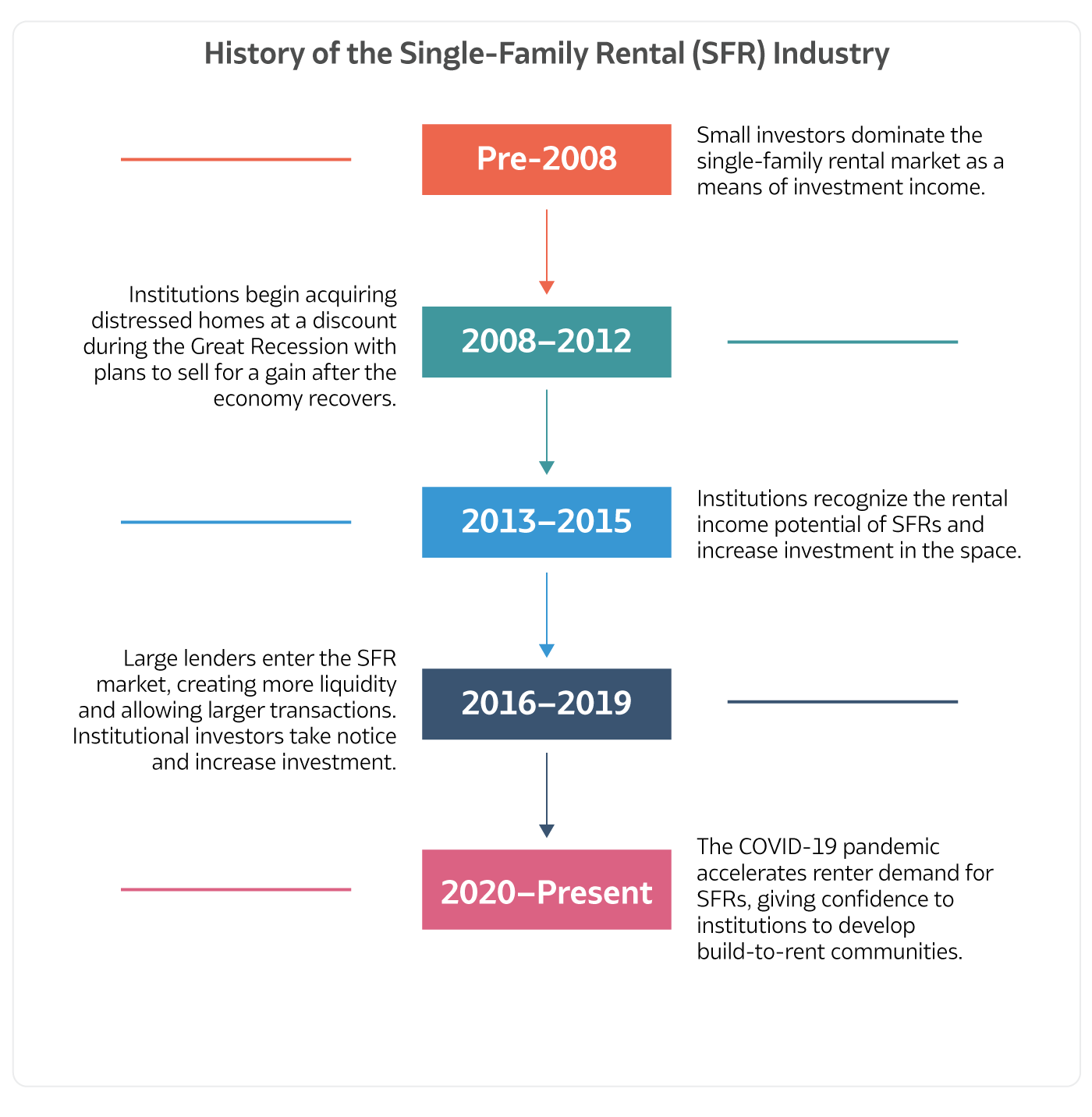

SFRs have made up more than 30% of all rentals in the country for at least the last three decades, according to an Amherst Capital report. Local landlords or individual “mom-and-pop” investors typically owned single-family rentals in scattered sites, and many of these investors even self-managed their assets as opposed to employing professional property management companies to oversee the operations of their properties.

Institutional investors typically avoided single-family rentals and opted to focus on other multifamily property types, such as garden-style and high-rise apartment buildings and complexes.

For institutions, owning portfolios with hundreds or thousands of single-family homes was viewed as challenging compared to the more traditional multifamily property types.

Single-Family Rental Becomes an Institutionalized Asset Class

The Great Recession caused a wave of foreclosures that left many single-family homes in distress. During this time, the U.S. homeownership rate fell from 67.8% in the first quarter of 2008 to a low of 62.9% in the second quarter of 2016, which matched the lowest record since 1965, according to the Census Bureau. Many people who lost their homes turned to SFRs during that time of transition as a place to live.

Some institutional companies realized that they could acquire single-family assets around the country in markets with good fundamentals at a steep discount. While they would initially rent out the homes, they had planned to sell them for a profit when the U.S. economy and the housing market returned.

That lead to an initial wave of institutions entering the single-family rental space, which helped increase the growth of the asset class. More than 3.8 million single-family rentals were added to the SFR inventory from 2006 to 2016, according to a report from the Terner Center for Housing Innovation at the University of California, Berkeley.

Institutions had certain advantages over mom-and-pop investors to operate SFRs thanks to their size including:

- More liquidity to acquire properties

- Access to cheaper financing, especially for an asset class that initially was not popular with traditional lenders

- More sophisticated management, and ability to offer better services and amenities to tenants

Through their positive experience after the Great Recession, pioneering institutional SFR investors discovered that single-family rentals were a strong business that shared the resiliency of other multifamily property types. They also recognized that the SFR market was enormous with ample opportunity to find more well-priced assets.

SFRs currently account for more than 37% of all rental inventory, equating to approximately 17 million units, according to Census Bureau estimates for the first quarter of 2021. This exceeds rental buildings with 10 or more units, which comprise 33.6% of all rental units.

Despite institutions entering the space since the Great Recession, SFRs are still dominated by non-institutional investors, who own 72.5% of the market. Institutional investors meanwhile only own 2.3% of the SFR market.

However, now that SFRs have attracted serious institutional interest, more lenders are increasing their loan activity in the industry, which will further institutionalize the asset class by increasing liquidity and allowing larger transactions to take place. Institutional lenders including Arbor Realty Trust, which is a member of The Arbor Family of Companies like ArborCrowd, have even created dedicated loan products to serve the asset class.

The Emergence of Build-to-Rent Communities within the Single-Family Rental Market

The COVID-19 pandemic caused the demand for homes to accelerate as people wanted more living space and privacy to social distance, and work or learn remotely. However, the surging demand, in conjunction with low inventory, high construction prices, and historically low-interest rates, pushed home prices to record highs, making homeownership unaffordable to many.

Many tenants have turned to single-family rentals as the solution. Even renters who traditionally favored urban areas have migrated to the suburbs for SFRs. According to the National Rental Home Council, 59% of single-family rental tenants moved from urban areas in 2020.

SFRs are especially in demand in Sun Belt cities because of the increased job opportunities, lower cost of living and milder climates they can offer. SFRs are appealing to renters for several reasons including:

- Flexibility to relocate when needed

- SFRs are seen as a first step towards buying a home

- SFRs provide the comfort of full-home living without the maintenance efforts and costs

As the tenant demand for SFRs continues to rise, institutional investors and home builders are now constructing homes for the explicit purpose of renting them to tenants. These projects, known as build-to-rent (BTR) communities, aren’t merely single-family rentals, but are purpose-driven developments of rental housing units.

These planned developments can include attractive amenities common to multifamily properties, such as pools, clubhouses, business centers, and playgrounds.

In the first quarter of 2021, approximately 43,000 build-to-rent units were started, a 4.9% increase compared to the same period in the prior year, according to the Census Bureau. Due to the high cost to develop BTR communities, these products are almost exclusively being constructed by institutional developers.

As single-family rentals continue to appeal to more residents, the BTR asset class is expected to play an important role in the multifamily housing industry.