With the Dow Jones reaching all-time highs, soaring past 28,000 in 2019, and the ten-year bull market continuing to inch up, investors are preparing for the next downturn that historical cycles indicate will inevitably arrive.

For investors, this could include shifting their more volatile investments, such as stocks, in a more stable direction. During a downturn, alternative investments, such as real estate, hedge funds or even art can retain value and produce greater returns than traditional investments.

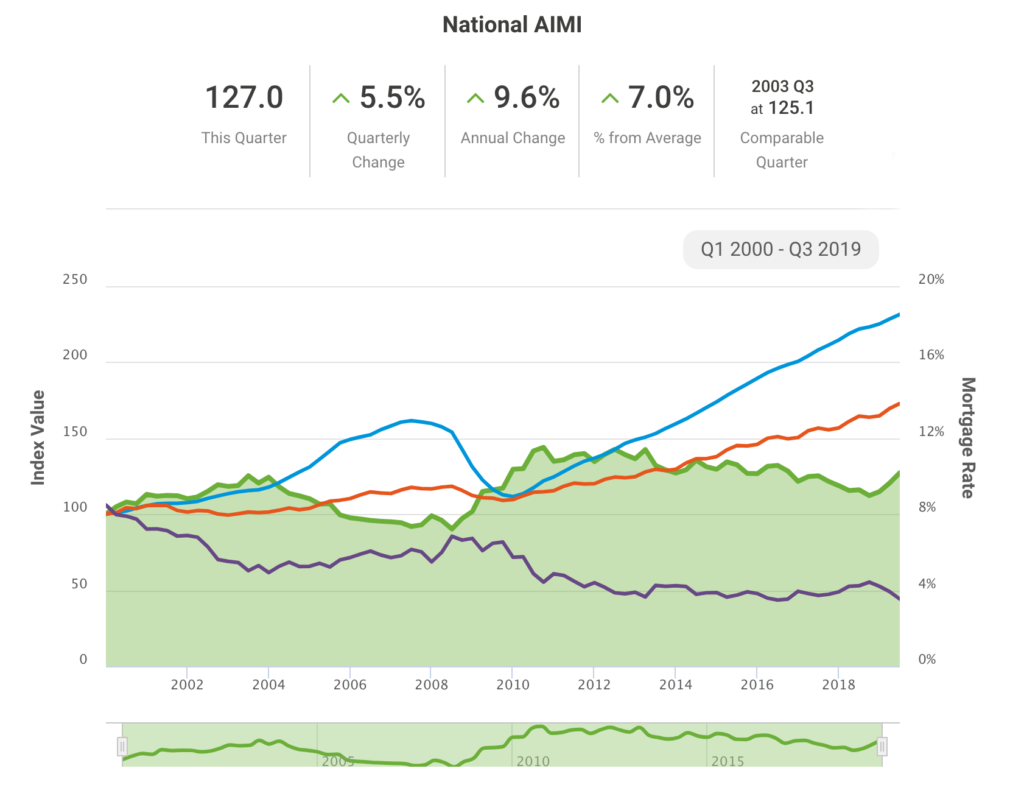

Chart by Freddie Mac: Freddie Mac’s national Apartment Investment Market Index (AIMI) shows that even after the 2001 and 2008 recessions, the housing industry’s income (orange) and prices (blue) generally continued to appreciate, and the investment market (green) has been stable over the same period, while mortgage rates (purple) have dropped significantly.

Real estate could provide an excellent opportunity for a more reliable investment that will help investors weather a downturn of any length. Real estate exhibiting sound fundamentals that is purchased and maintained with reasonable debt levels is generally seen as a more stable investment than stocks. As a physical asset with inherent value, it is more likely to hold that value.

Multifamily in particular is often seen to have less risk, in part for the simple reason that no matter how hard the economic times, everyone needs a place to live. A recent look at a possible upcoming downturn by RCLCO found that “few analysts expect the next recession to have similarly devastating impacts” on the multifamily market. Factors like fixed-mortgage interest rates and rising rent payments can also help hedge against inflation.

Quality real estate transactions were historically difficult to access with high minimum investment requirements and a complexity to operate that an average investor simply did not understand.

With the advent of real estate crowdfunding, retail investors can now invest in commercial real estate without having to purchase properties on their own or spend the high six-figure minimums required for investments in private equity.

Crowdfunding – an easier-to-access form of real estate syndication that came into existence with the passage of the Jumpstart Our Business Startups (JOBS) act of 2012 – allows individuals to simply connect with a real estate crowdfunding company online, assess a fully-vetted, long-term commercial real estate project, and then submit their investment in that project, thus allowing investors at all levels to diversify their portfolios.

Real estate crowdfunding has proved to be so popular that it has already become a multibillion dollar industry.

The advantages of investing through real estate crowdfunding are numerous. Real estate crowdfunding is an alternative investment, which means it does not always correlate to the stock market and could provide valuable diversification to any portfolio. Additionally, it can provide a passive income stream within a stable class of investments amid uncertain market conditions.

As real estate crowdfunding is still a relatively new industry, it’s essential that investors vet companies for experience, transparency, and rigorous underwriting standards, ensuring they present deals with sound fundamentals that can offer realistic returns. While these are solid guidelines for investing with a crowdfunding company at any point, they will prove especially important in the face of a market correction.

As real estate crowdfunding is still a relatively new industry, it’s essential that investors vet companies for experience, transparency, and rigorous underwriting standards, ensuring they present deals with sound fundamentals that can offer realistic returns. While these are solid guidelines for investing with a crowdfunding company at any point, they will prove especially important in the face of a market correction.

ArborCrowd, a member of The Arbor Family of Companies, was the first crowdfunding platform to be part of a real estate institution. The company presents detailed offering materials for each deal it offers, including extensive offering overviews, executive summaries, and private placement memorandums, so investors are equipped to make the right decisions for their investment objectives.

Crowdfunding has proven to be a viable, worthwhile, and easily accessible platform for real estate investments at all levels. As investors face the volatility of stocks and bonds head-on during the inevitable downturn, the stability of real estate reached through crowdfunding can potentially serve as a safe haven.