The capital stack is an important concept in real estate investment, as it details how a transaction is financed. Most commercial real estate acquisitions or developments receive investment from more than one source, and from investors with different goals.

Now that crowdfunding is mainstream, and retail investors have access to a wide range of commercial property opportunities, it’s important to understand how capital stacks are put together, and what it means to put your capital in one part of the stack or another.

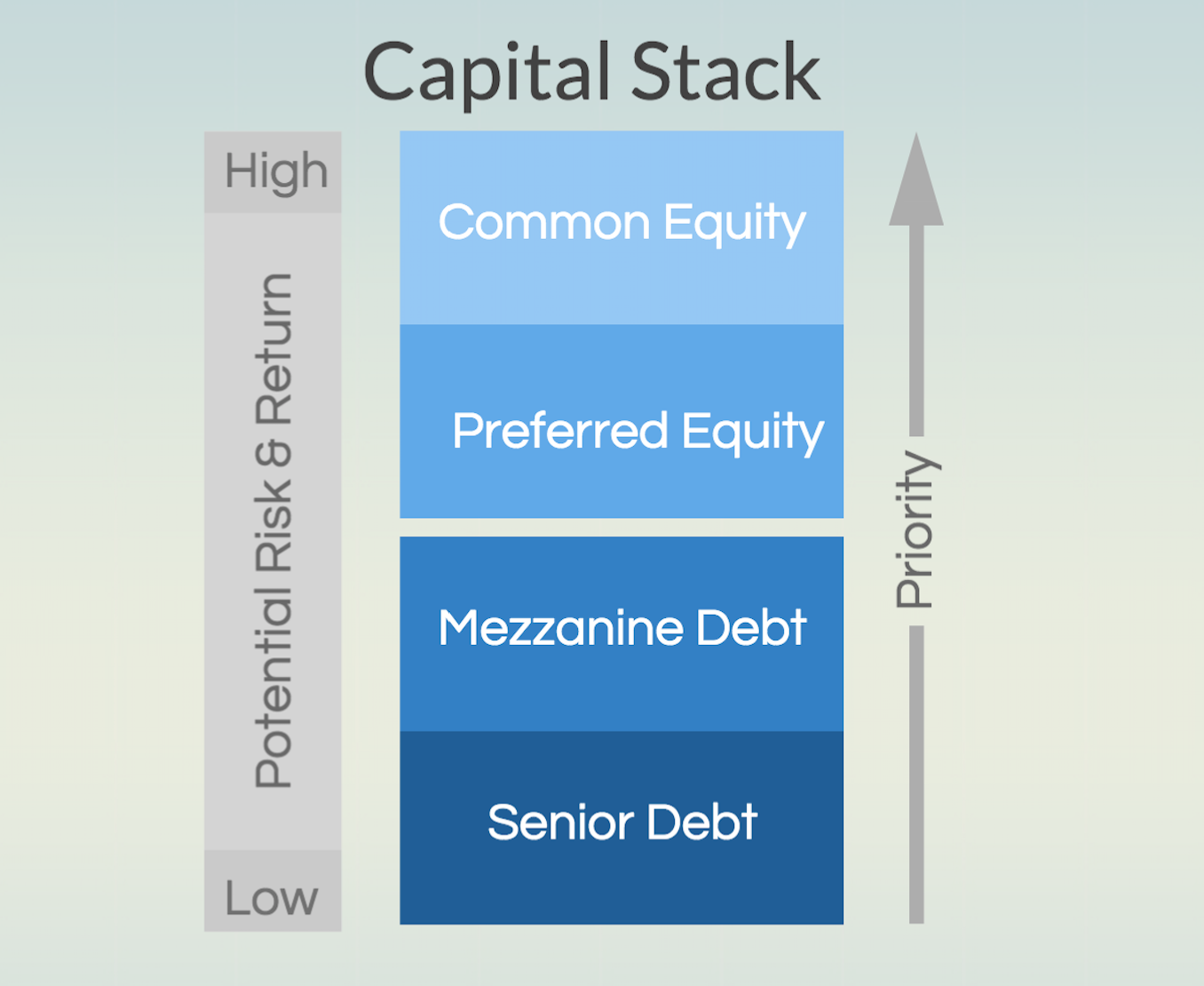

The two main divisions in the capital stack are debt and equity financing. Most real estate deals use both kinds, for reasons discussed below.

The Debt Side

Debt financing means that a capital source lends a buyer or developer money to buy or build a property. For most deals, debt financing is the primary source of funding, because most buyers and developers don’t have the capital on hand to do deals, especially the multimillion-dollar property sales common in commercial real estate. For the debt financing on a property deal, the goal is to create enough value — either by leasing more units, raising rents, or improving net operating income and executing a sale — so that the debt financing can be paid with a sizable profit left over.

Previously, institutions almost always provided debt financing, especially for larger deals. That included banks, insurance companies and other entities whose business involves accumulating and lending capital, or sometimes ultra-wealthy individuals and families.

As a result, commercial real estate development and acquisition specialists tended to establish longstanding relationships with providers of real estate finance. They might not always have gotten the exact terms they wanted, but banks and other large lenders were the only game in town.

Large lenders still provide most debt financing for real estate, but now crowdfunding offers alternate sources of real estate capital. Until crowdfunding, it was difficult for ordinary investors to take advantage of property investment opportunities requiring debt financing.

The Equity Side

The other major part of the capital stack is equity financing. Equity investors put capital directly into deals and become part owners. Like debt financing, equity financing used to be the exclusive province of large institutions and wealthy individuals. Also like debt financing, crowdsourcing has made it easier for ordinary investors to get a piece of the equity action.

Generally, the developer of a new property will have an equity stake, as will an investor in an acquisition, a situation that’s known in the commercial real estate industry as having “skin in the game.” Other debt or equity providers are reluctant to invest in a deal in which the primary developer or owner/operator doesn’t have any skin in the game. It can show a lack of seriousness about the project or unwillingness to take on risk.

Details, Details

Of course, commercial real estate capital stacks aren’t as simple as debt and equity. Those are the broad categories of investment and a handy — but simplified — way to think about the capital stack. Within those categories, there are different classes of investment, and it’s worth paying attention to those as well.

On the debt side, there’s senior debt and mezzanine debt (often called mezz debt). As the name implies, senior debt takes precedence over mezzanine. Holders of that kind of debt are the first to be paid from the investment’s income, and first to be paid if the investment falters in some way. Mezz debt is next in line.

Senior debt is less expensive for the borrower, and thus pays less to the lender, but it is the safest class of investment in a commercial real estate deal. It also usually has the right to secure recorded liens against the underlying asset.

Mezz is accordingly more expensive for the borrower, and pays better to the lender, because of the higher risk. Why have mezzanine debt at all? Lenders that specialize in senior debt generally limit how much they will lend as a percentage total the capital needed to make the deal work — such as 60 percent or 70 percent, depending on the state of the market, the asset itself, and other factors. Equity rarely fills the other 40 percent or 30 percent of the capital stack completely, so mezz lending fills the gap.

On the equity side, the capital stack is typically divided into preferred and common equity. The two take their names from the equities markets, where corporate shares are often in one of those two classes. Investors in preferred equity, while lower in priority after all of the debt side, are still paid before investors in common equity. Thus the highest risk in the stack is common equity.

Why would anyone invest on the equity side, except for those that have to have skin in the game? True, the risks are greater, but so are the potential rewards. Equity investors not only enjoy income generated by a property that’s doing well, but they also can profit handsomely from the property’s appreciation over the term of their investment. Debt-side investors don’t reap that kind of reward.

The Takeaway

Like any investor, a crowdfunding investor needs to determine their strategy before contributing to a capital stack. What’s more important: a steady income, or the opportunity for sizable capital gains? How much risk is acceptable? A careful examination of the asset, as well as the proposed capital structure, is as important for a crowdfunding investor as any other investor — wherever they want to be in the capital stack.

For a more detailed look at the pros and cons of investing in debt vs. equity through crowdfunding, we put together a nice guide located here.