How Has Crowdfunding Evolved?

In six short years online crowdfunding has grown from a novel way to develop interesting consumer products into a powerful way to invest in alternative asset classes. This sea change is arguably most apparent in the real estate sector.

Individuals who could never access property-level commercial real estate investments such as apartment buildings or shopping centers are now able to use technology to pool money together with fellow investors in order to capitalize on the historically stable asset class. But how did we get here?

Roots in Lady Liberty

The first major crowdfunding campaign in the U.S. occurred 131 years ago. It was the summer of 1885 and the Statue of Liberty sat unassembled in New York. Though the statue was paid for by France, the U.S. had not raised the $250,000 (roughly $6.4 million in 2016 dollars) needed for a granite pedestal.

With local, state and Federal governments declining to front the funds, Joseph Pulitzer decided to turn to the crowd through his paper The New York World, securing investments from 160,000 donors in just five months. The majority of donations were under $1 — imagine being the accountant keeping tabs on that — and all contributors received recognition with their name printed in the paper.

Crowdfunding in the Internet Era

Fast-forward 120 years. By the turn of the millennia the wide adoption of the Internet had significantly reduced the barriers of distance, time and effort needed to market, collect and deploy funding.

Formed in 2005, Kiva would become the first crowdfunding platform to be a household name. The crowdfunding pioneer allows individuals to lend money to low-income entrepreneurs in over 70 countries with the aim of eliminating poverty. While lenders earn no interest on the loans, there is a 99+% repayment rate, so the platform is essentially a charity crowdfunding portal. Charity crowdfunding sites have since grown in popularity. One of the most popular today is GoFundMe — a portal that has raised over $2 billion to help cover medical bills, memorials, volunteering efforts and more.

Shortly after Kiva we saw the rise of rewards-based crowdfunding, where backers receive a gift related to the crowdfunding campaign. The two main driving forces were Indigogo (formed in 2008 with a focus on funding films) and Kickstarter (formed in 2009 with a general focus on funding creative projects). Today you’ll find a wide spectrum of projects, products and technology to fund, such as iPhone cases that print your photos or smart tape measurers that uses ultrasonic sensors and store measurements.

Investment Crowdfunding Takes Off

Shortly after rewards-based crowdfunding entered the mainstream, news emerged that individuals would soon be able to participate in investment crowdfunding due to new regulatory initiatives. In April 2012, President Barack Obama signed the Jumpstart Our Business Startups (JOBS) Act into law [1]. A key feature of the JOBS Act was direction to the Securities and Exchange Commission to adopt new rules. Rule 506(c) is of particular importance, as it removed the prohibition on “broad based advertising” that previously kept investment sponsors (the people raising the funds) from reaching out to Accredited Investors. A look at the popularity of ‘crowdfunding’ as a Google search term below tells the story of the JOBS Act impact.

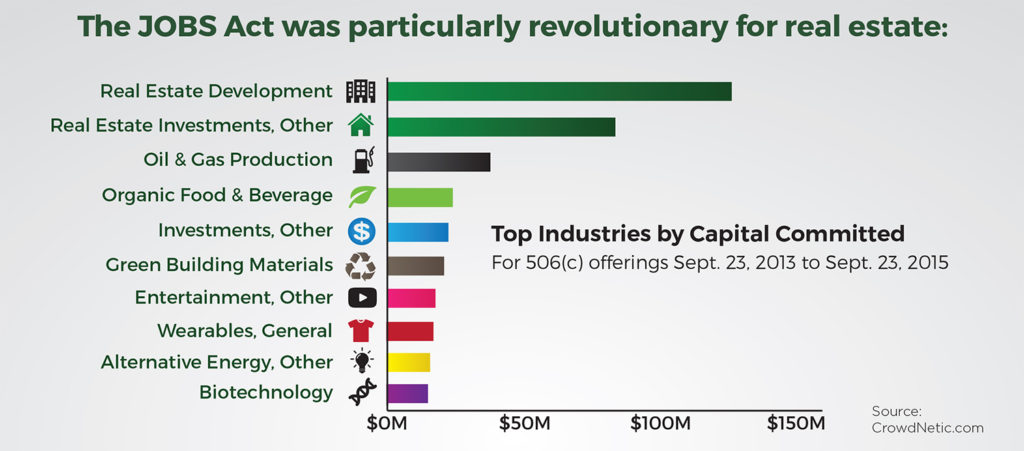

Real estate companies could now advertise their investment opportunities to accredited investors. High-quality commercial real estate investments were no longer only offered on a ‘who you know basis’. With more individuals able to invest, the barriers to entry were lowered significantly. This timing of the law paired up well with volatile equity markets, and investors were quick to begin exploring a new asset for their portfolios. As shown below, real estate is by far the most popular industry in terms of capital committed through 506(c) offerings.

These offerings come from no shortage of real estate crowdfunding portals — some that serve as a marketplace for third-parties to raise funds, and others custom built by companies doing their own deals. Offerings exist in most major metropolitan areas, and investors can select which commercial asset class (e.g. multifamily, office, industrial, hospitality or retail) and operational strategy (e.g. ground-up development, redevelopment, value-add) best fits their investment goals.

If you’re a first-time real estate crowdfunding investor, the keep the following list of tips in mind as you explore this exciting sector.

Vogel J, Moll, B. Crowdfunding for Real Estate. The Real Estate Finance Journal, Summer/Fall 2014.