The Federal Reserve raised its benchmark interest rate by three-quarters of a percentage point for the fourth consecutive time this year in November (its sixth overall rate hike of 2022) to combat persistently high inflation.

The Fed’s latest action brings its benchmark rate to a target range of 3.75% to 4%, which is the highest since January 2008 during the Great Recession. The U.S. inflation rate was 8.2% in September, near a 40-year high, and well above the Fed’s historical 2% target.

Despite high inflation and interest rates, U.S. gross domestic product (GDP) rose at an annual rate of 2.6% in the third quarter, ending a streak of two consecutive quarters of negative GDP growth. Additionally, the economy added 261,000 jobs in October and the unemployment rate was 3.7%, near historical lows.

Economists had expected the positive GDP growth for Q3 and considered it a “one-off” occurrence, according to CNBC. A majority of economists, however, forecast that the U.S. economy will enter a recession in 2023. Due to slowing growth and less profits, experts believe job cuts will accelerate in 2023 as companies seek to protect their balance sheets.

After the latest rate hike announcement, Fed Chairman Jerome Powell hinted that the central bank could issue smaller rate increases in the future, but the Fed was still unsure how high rates will need to be raised. The Fed hopes to achieve a “soft landing” through the rate hikes or the gradual easing of economic growth to curb inflation without dragging the economy into a recession.

The housing market is already experiencing the pressures of rising interest rates as average mortgage rates for 30-year fixed loans briefly eclipsed 7% and are expected to continue increasing, impacting demand to purchase homes. Sales of existing homes dropped to a 10-year low in September. Home prices, which were inflated to record highs during the COVID-19 pandemic, have begun to fall as homebuyers are moving to the sidelines, but prices are still near historical highs.

Due to lower for-sale housing demand, construction material prices for items such as lumber and aluminum have been decreasing. However, as households still desire to live in homes, demand remains solid for single-family rental (SFR) and build-to-rent (BTR) communities. Sponsors now have an opportunity to build SFR/BTR properties for reduced costs.

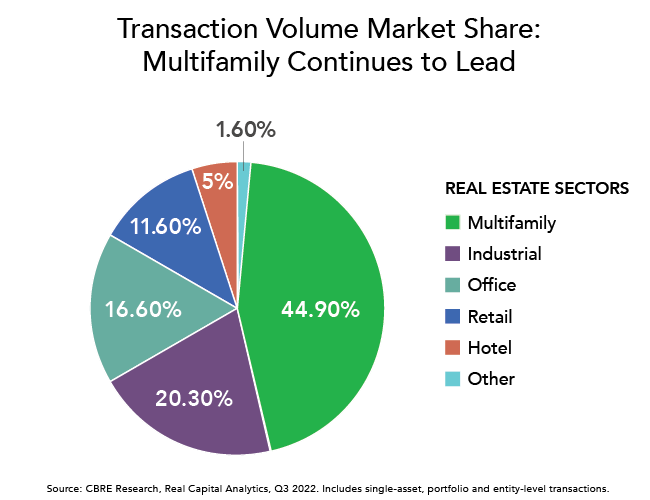

The high interest rate environment is softening the commercial real estate market by slowing sales volumes and reducing financing availability, however, multifamily remains the top sector for investment.

According to CBRE’s Q3 2022 capital markets report, the commercial real estate industry suffered a 24% decline in investment sales activity year-over-year in Q3. Multifamily led all real estate sectors with $69.3 billion in investment volume during the quarter, which was 44.9% of all real estate transaction volume. The industrial sector was next with $31.4 billion.

Due to economic uncertainty and high interest rates, there could potentially be an opportunity for real estate investors to identify price dislocations in the near-term. However, in such an uncertain environment, it’s paramount to partner with sponsors and platforms led by experienced real estate professionals who have been successful in finding opportunities in various market cycles.