Sign up to receive more useful insights from our seasoned professionals and in-depth deal information.

Stay informed about the latest trends and new investment opportunities.

WHAT IS IRR (INTERNAL RATE OF RETURN)?

One of the most common metrics used to gauge investment performance is the Internal Rate of Return (IRR). It is one of the first performance indicators you are likely to encounter when browsing real estate crowdfunding opportunities.

Typically expressed in a percent range (i.e. 12%-15%), the IRR is the annualized rate of earnings on an investment.

A less shrewd investor would be satisfied by following the general rule of thumb that the higher the IRR, the higher the return; the lower the IRR the lower the risk. But this is not always the case.

While there is no concrete definition tying asset class to IRR, the following IRR ranges can be generalized as follows.

- Core: 4% – 8% IRR

- Core Plus: 8%-12% IRR

- Value-Add: 12% – 16% IRR

- Opportunistic: 16+% IRR

What is a Good IRR and What is a Bad IRR?

There are several crucial factors to consider when evaluating what makes a “good” IRR for your own needs.

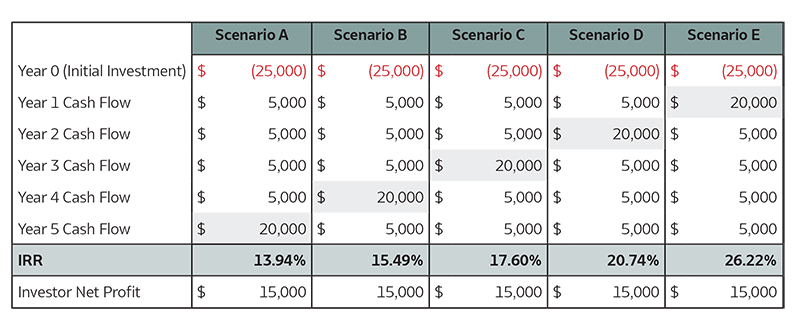

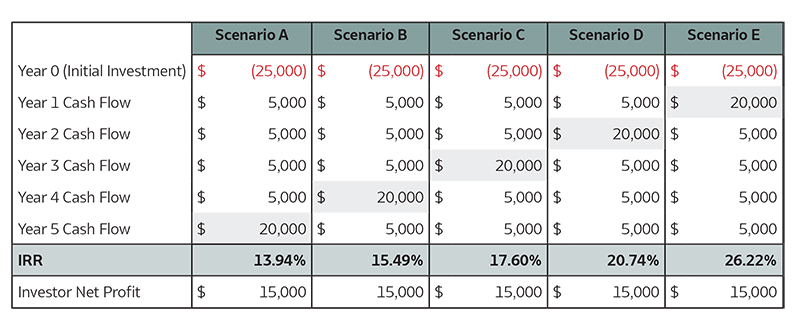

Interestingly, deals with the same profit to an investor can have varying IRRs because of when the deals’ cash flow is distributed. Take a look at Scenarios “A” through “E” below.

While all five scenarios have the same net profit of $15,000, the IRR values range from 13.94% to 26.22%. The scenarios with more cash flow distributed towards the beginning of the hold period (“D” and “E” above) will end up having higher IRRs. This is because of the “time value” of money. (To learn more about this, see our article on how to calculate IRR.)

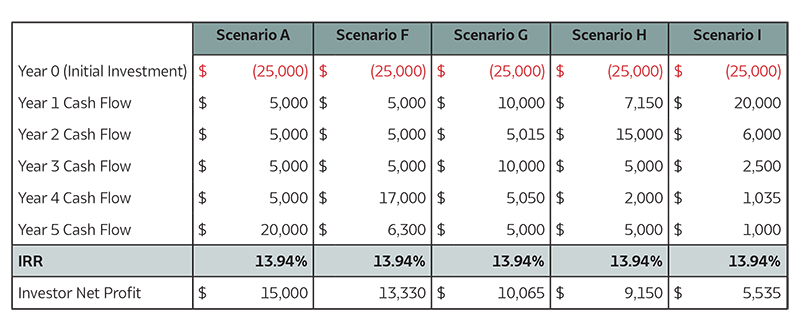

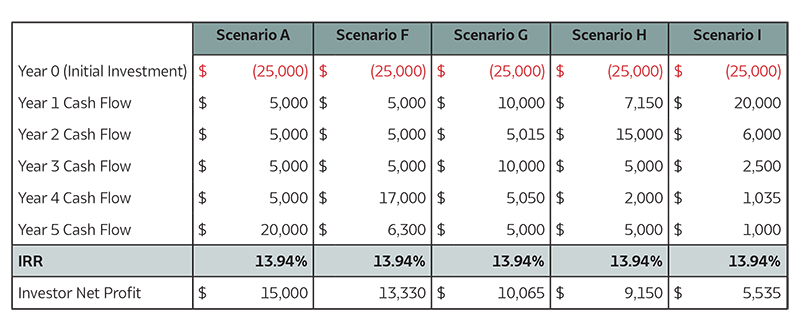

Just as deals with the same profit to an investor can have different IRRs, deals with the same IRR can have wildly different profits. This is demonstrated by Scenarios “F” through “I” below.

So, which of these scenarios above is best for an investor? It really comes down to what the investor is looking to get out of the deal. Scenario “I” might have the lowest investor net profit, but the investor is getting the vast majority of their investment back in Year 1 and could put those funds to work somewhere else. On the contrary, scenario “A” is perfect for an investor who has no need for that money for a few years, and they are rewarded for their patience with a higher net profit.

So, what does this all mean for an investor looking to get involved with real estate through crowdfunding? The IRR is just one metric to examine when performing due diligence on a commercial real estate investment opportunity. Its calculation is a complex formula, which is explained in our article. When combined with other metrics — such as the Equity Multiple, in particular — the IRR can paint a much more accurate picture of how the investment is expected to perform.

Register to access in-depth investment details and alerts about new deals.

Join the ArborCrowd Community for more access.

Disclaimer:

The calculators contained on this website (each a “Calculator”) are meant solely to be educational and informational tools and are not intended to be, and shall not constitute, investment, legal or tax advice. ArborCrowd Holding Company, LLC, its subsidiaries and affiliates (“ACHC”, “we” “our” or “us”) make no representations, guarantees or warranties to their accuracy. All results generated by any Calculator are hypothetical, may not reflect the actual growth or profits of any investment made, and are approximations. We are not responsible for the consequences of any decisions or actions taken in reliance upon or as a result of the information provided by any Calculator. The Calculator utilizes assumptions which may not be relevant to your individual situation. Some of the assumptions used in the Calculator are contained below, but we make no representations, guarantees or warranties that this list is accurate or exhaustive. Additionally, we make no representations or warranties that the assumptions used in the Calculator are accurate, reasonable or market nor that the Calculator is free of errors or omissions. All results generated by any Calculator may not take into account taxes, fees, costs or expenses. An actual investment may yield different results from any hypothetical results shown and there can be a potential for loss. The Calculator shall be used at your own risk. Consult with a financial, legal and/or tax professional prior to relying on any results provided by any Calculator.

Real Estate Investment Returns Calculator assumptions:

- IRR and returns based on annual compounding

- Cash on cash distributions paid annually at end of each respective year