Single-family rentals (SFR) and build-to rent (BTR) communities, ground-up portfolios of homes exclusively for rent, are experiencing high renter demand that’s propelling the property types to the upper echelon of the real estate industry. The asset class is having its moment in the sun as investors and developers make significant equity investments in the space after largely ignoring it for several decades. With the factors driving demand appearing to be long-term trends, SFR and BTR are poised to continue to gain attention from large equity investors reminiscent of the growth seen with traditional multifamily properties decades earlier.

There is a reason that at least $21 billion of institutional investments have been injected into the SFR and BTR asset class between March 2020 and June 2021. These investment dollars are a result of investors following the significant and increasing renter demand for this property type. The seemingly insatiable renter demand is the result of several factors:

- Relative affordability compared to homeownership

- Amenities of single-family homes and build-to-rent communities

- Various demographic shifts

Single-Family Rentals and Build-to-Rent Communities Provide More Affordability Compared to Homeownership

The popularity of single-family homes expanded dramatically during the COVID-19 pandemic, as people desired more privacy, and space for remote working and learning. In fact, Americans increased home buying last year to a pace that matched a previous record set in the housing boom of 2003-2004, according to the Pew Research Center. The demand pushed home prices to all-time highs. The median price of a home sold in the U.S. increased to a record $374,900 in the second quarter of 2021, a 16.2% increase from $322,600 a year earlier.

Purchasing a home was already a monumental expense for most families prior to the pandemic, and the recent price surge has made homeownership even more unaffordable for nearly two-thirds of the country. According to Attom Data Solutions, homes are less affordable than historical averages in 61% of counties across the nation in the second quarter of 2021, up from 48% of counties a year ago. People who want to live in houses but can’t afford the down payment, mortgage, closing costs, and cost to maintain the property, can have the flexibility they need with single-family rental units. SFRs and BTRs give tenants most of the perks of homeownership but without the high costs.

Amenities of Single-Family Rentals and Build-to-Rent Communities for a Certain Lifestyle

Urban areas are known for their cultural attractions, which entice a vast amount of people to live in those areas. By living in an apartment building in the city, residents have access to various restaurants, clubs, bars, and live musical or theatrical performances.

However, living in single-family rentals or build-to-rent communities in the suburbs has perks as well, albeit for a different kind of household. These amenities are more geared to families, and include:

- Yard space

- Private driveways and garages

- More interior space

- More privacy

- High-quality schools

- Less crime

- Quieter neighborhoods

- More green spaces

- More space for pets

Build-to-rent units specifically often have amenity packages on par with traditional multifamily buildings, such as:

- Clubhouses

- Pools

- Barbecue pits

- Dog walks

- Fitness centers

For many residents, living in a single-family rental or build-to-rent community also gives them a sense of having a home, which helps them take a step towards homeownership. This is important because most tenants eventually want to become homeowners. According to a survey of single-family rental residents by the Terner Center of the University of California, Berkeley, 80 percent of respondents want to own a home eventually. Even more compelling for many is the benefit of having a home without the arduous upkeep that a home requires. Single-family rental or build-to-rent communities are usually operated by professional management companies that handle all landscaping, snow removal, and interior and exterior repairs.

Demographic Shifts Affecting Single-Family Rental and Build-to-Rent Community Residents

In addition to record home prices and preference of amenities, various demographic shifts are affecting the demand for single-family rentals and build-to-rent communities, including:

- Millennials starting families

- Companies moving to areas with lower cost of living, less density and higher quality of life

- COVID-19 accelerating the work-from-home trend

With approximately 72.1 million millennials (people currently between ages 25 and 40), this group accounts for the largest generation in the country. And millennials have reached a stage of life where they are marrying and starting families and, therefore, require more space. Most millennials want to own a home, and 74% of millennials who are interested in purchasing a home want to do so soon, according to a study late last year by online real estate marketplace Point2. But the same study revealed that 88% of millennials have less in savings than the average national down payment of $62,600. As millennials saddled with student debt are starting to look for their first homes, many are finding the prices are too high and choosing single-family rentals instead.

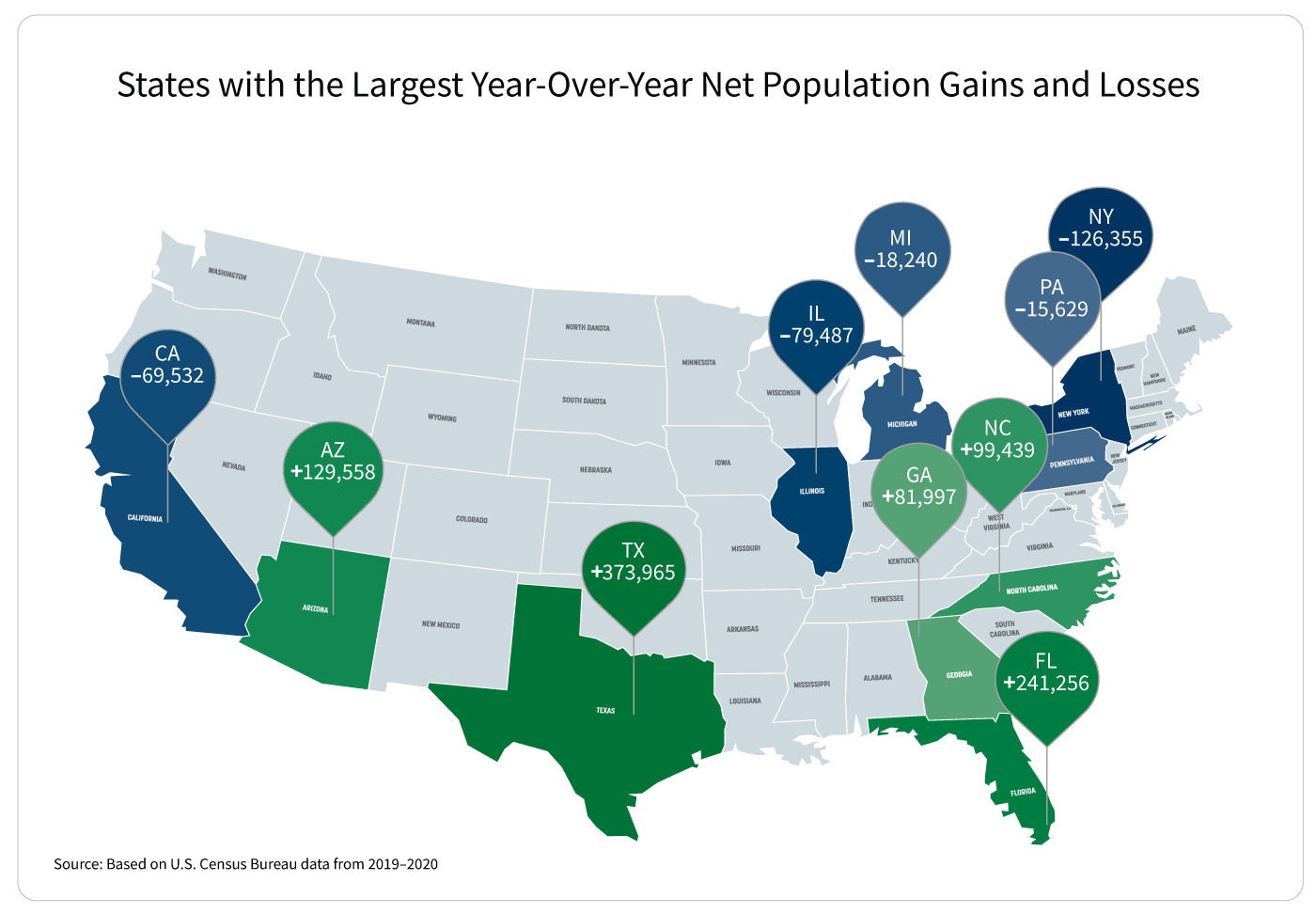

Millennials aren’t the only ones looking for affordable options; businesses are also focused on reducing costs. Many companies based in high-cost, large cities have started to relocate to other areas of the country with less density, more business-friendly policies, less regulations, lower cost of living for employees, lower taxes and milder climates. Most notably, many businesses are choosing cities within the Sun Belt region of the United States for the aforementioned reasons. These cities have been popular for single-family rentals and build-to-rent communities, as they’ve historically had enough space and cheaper land for this product type, and workers are following these companies to smaller cities.

However, being near a place of employment is not important for all workers. The COVID-19 pandemic revealed that remote working is a viable option for many employees. This trend emerged prior to the pandemic, but accelerated quickly under the constraints of policies instituted to prevent the spread of the virus. Remote working was the reason why 20% of those who moved chose to relocate last year, and nearly a third of workers who have moved or plan to move are relocating from cities to the suburbs, where single-family rentals and build-to-rent communities are more likely to be available, according to a Homes.com survey. Many experts believe that even after COVID-19, remote working will reshape the work environment.

With the trends driving renter demand of single-family rentals and build-to-rent communities showing no signs of slowing down, the asset class continues to explode. This growth, while a result of renter demand, will ultimately be sustained by the major increase in equity investments into this asset class. Institutional equity, as well as lenders, have taken note of the growth potential of the single-family rental and build-to-rent community space, even further increasing the funds needed to make this asset class continue its impressive growth trajectory.