Diversification is a fundamental principle in finance and is used by large financial institutions to maximize returns while also minimizing risk. To diversify an investment portfolio, institutions combine investments that are not directly correlated with each other by investing across various financial instruments, markets, asset classes, and across the risk spectrum. By doing this, they can achieve a desired return with a lower overall risk than they would be able to do investing in just a single asset class.

However, diversification to public equities markets from institutions can affect private real estate investments because of the “denominator effect.” In this article we’ll explain the denominator effect, a byproduct of institutional diversification.

What is the Denominator Effect?

A portion of what institutional investors, such as pension funds, allocate their portfolios to is private institutional quality real estate, partly because as an alternative investment, real estate can be less correlated to more liquid investments, like the public equities and bond markets. However, it is possible to see pricing of private real estate impacted by movement in the broader public equities markets and other asset classes. One way that real estate markets can be impacted by other financial asset classes is through the denominator effect, which occurs when an institutional investor’s portfolio allocation crosses certain mandates as a result of one or more assets increasing or decreasing in value, resulting in the need for a rebalancing.

Institutions and Portfolio Mandates

Pension funds provide an important and sizable portion of capital to the private real estate market. This is important to note, as pension funds along with endowments and certain other institutional investors have mandates that dictate the allocation of various assets in their portfolios. These mandates are stated in terms of a percentage of the value of their portfolio. As a result, pension funds, endowments, and other institutional investors are constantly rebalancing their portfolios and adjusting allocations to stay in compliance with their diversification mandates.

So, what happens when there is a sudden change in the value of a component of their portfolio? Say for example there is a crash in the U.S. stock market, and the value of a pension fund’s domestic equity portfolio plummets. As a result, that pension fund may become heavily over allocated to other asset classes, for example real estate. This is the denominator effect. Essentially large shifts in the value of an institution’s portfolio can increase or decrease the denominator (used in the ratio to determine an asset’s percentage of the portfolio) and cause their asset allocations to be out of balance.

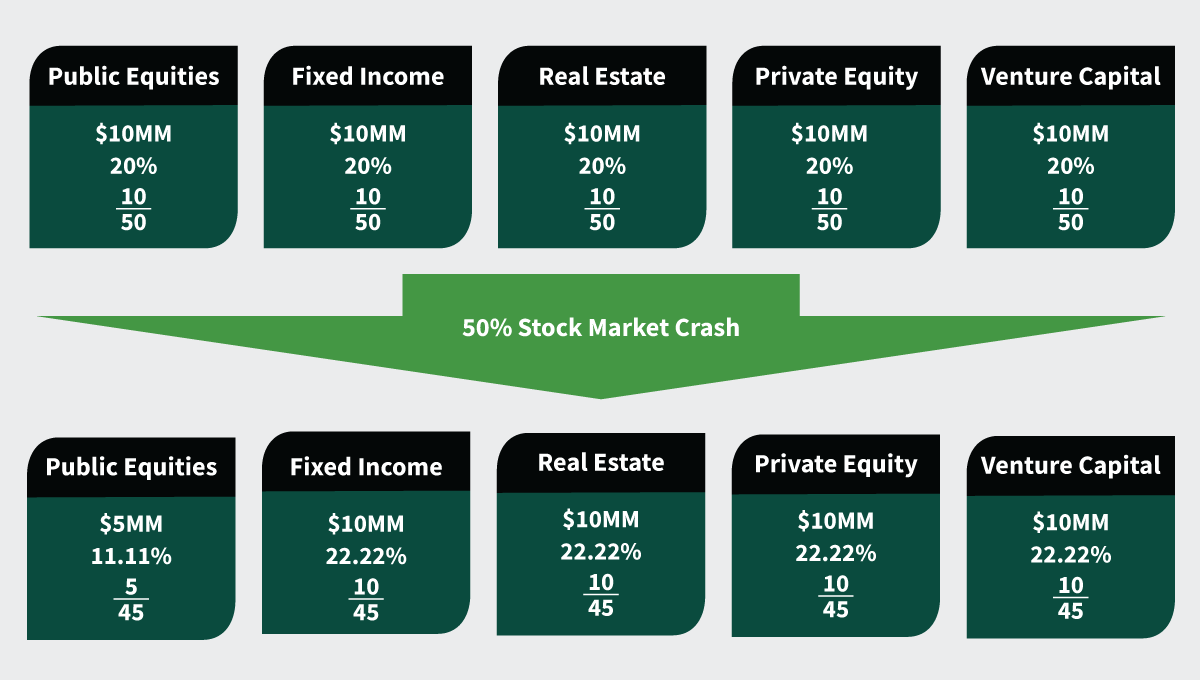

Simplified Portfolio Allocation to Show the Denominator Effect

After a 50% stock market crash, the asset allocation to public equities was significantly reduced below the 20% mandate, meaning the institution could reduce contributions to other assets like real estate to rebalance its portfolio.

How Can Adjustments to Asset Allocations Impact Real Estate Markets?

The disruption of asset allocations because of market fluctuations can affect real estate markets in several ways. Since real estate is an illiquid asset, the denominator effect could cause institutional investors to need to sell real estate at an inopportune time, which could create opportunities for other investors to buy such real estate at an attractive basis.

The denominator effect could also cause a reduction in the amount of capital flowing into private real estate markets. Pension funds, endowments, and other institutional investors that have allocation mandates could decide in concert with selling assets to temporarily limit or halt additional investment in real estate. This reduction in the amount of dry powder on the sidelines looking to enter real estate could put upward pressure on capitalization rates (commonly known as “cap rates”) and downward pressure on asset pricing. Lower asset pricing would then make it a less opportune time to exit investments, reducing overall returns for other investors looking to harvest gains and sell an investment upon completion of a business plan.

More recently we have seen public equities markets outperform relative to historical performance. Just as a decrease in the value of a pension fund’s public equity assets could cause them to rebalance their portfolio through selling private real estate or limiting additional investment into real estate, a large increase in the value of an institution’s public equities investments or any other investment outside of real estate could have the opposite effect. An increase in the denominator resulting from appreciation of non-real estate assets could cause pension funds to rebalance their portfolios through purchasing more real estate or increasing their total dollar value allocated to the asset class. This could result in downward pressure on cap rates as more dry powder enters the real estate market, and competition to purchase assets increases.

It’s important to note that pension funds, endowments, and other institutions do have flexibility when making decisions as it relates to rebalancing their portfolios. Of course, they will consider the impact that any reallocation of assets will have and make decisions accordingly, however, the diversification mandates do still exist.

The Role of Private Real Estate in Retail Investors’ Portfolios

While retail investors don’t have to worry about rebalancing their portfolios to meet an allocation mandate, they can be impacted by phenomena such as the denominator effect. Such a phenomenon could create attractive opportunities to purchase real estate or create obstacles when exiting investments by softening certain markets if there is a greater desire to sell real estate than buy it overall. The obstacles can be seen as less relevant to retail investors since they could choose to hold on to real estate investments until a more opportune time to sell without worrying about allocation mandates.

In either sense, it can be wise for retail investors to diversify their investment portfolios. Crowdfunding has increased the opportunity for retail investors to access institutional quality real estate investments, which was historically very difficult to source or limited by the large check sizes required to invest in commercial real estate.

Crowdfunding with platforms like ArborCrowd can be an attractive way for retail investors to diversify their investment portfolios by adding private real estate. When properly diversified with other assets, a portfolio may have less overall risk relative to an expected return.