Commercial real estate has long been considered a generational wealth builder because of its numerous advantages, such as tax benefits, asset appreciation, and potential cash flow from distributions. With the advent of real estate crowdfunding, it’s become even easier to invest in commercial real estate.

While the U.S. economy is still not out of the woods from the COVID-19 pandemic, thanks to the vaccine rollout and continued social distancing, the picture is clearer than last summer. It is now possible to assess the impact that COVID-19 has had on investments and markets, and more importantly, what the recovery may look like. Here are five reasons we believe that it’s worth taking a look at commercial real estate in 2021.

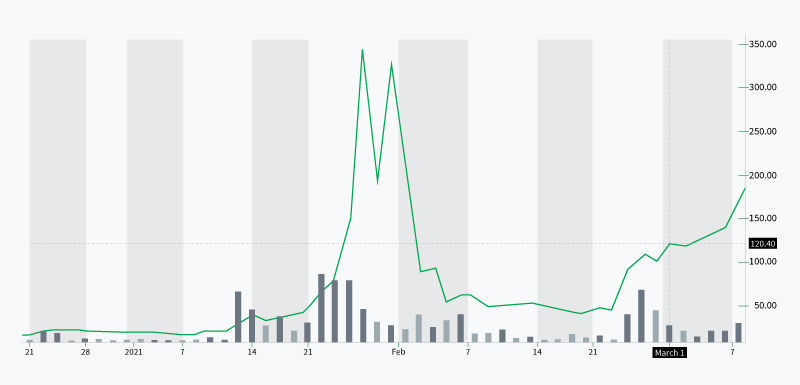

Stock Market Speculation (and Manipulation)

The stock market has seen wild fluctuations over the past year, and for reasons that were not necessarily tied to fundamentals in some instances. The most recent case involved retail traders banding together on the social networking site Reddit to drive up prices and force a short squeeze in so-called “meme stocks.” These included stocks like GameStop (GME), AMC Entertainment Holdings (AMC), BlackBerry (BB) and many others that large financial institutions had heavily shorted. The pricing momentum and notoriety caused scores of other investors to similarly ignore fundamentals and invest in those stocks after well-known figures, such as Tesla and SpaceX CEO Elon Musk, showed support for the retail investors. The popularity created speculative price bubbles in those stocks, which eventually popped, but has returned to higher prices in part.

Throughout its long history, the stock market is well known for its wild swings. Market speculation on social media strategies from amateur investors seems to be the latest driver of the volatility. Meanwhile, real estate investments are based on physical property and real fundamentals. Seasoned sponsors typically use rigorous underwriting, research and planning prior to execution of a business plan. And the private real estate market is generally uncorrelated to the stock market and not subject to such wild swings.

Market Performance: GameStop Corp. (GME)

Source: Yahoo! Finance

Source: Yahoo! Finance

GameStop ballooned from $19.96 at the market close on Jan. 12 to $347.51 on Jan. 27 until falling back to $53.50 on Feb. 4. It has since recovered some of those losses.

COVID-19 Cases are Declining

While many people continue to contract COVID-19 each day, the general sentiment is that there is light at the end of the tunnel. Vaccines started being administered in mid-December 2020, and daily new cases hit a peak of about 315,000 cases in early January, but have since dramatically plummeted each week, according to data from the Centers for Disease Control and Prevention. On March 7, new daily cases total just 41,675. The White House announced on Feb. 11 there will be enough vaccines for 300 million Americans by the end of July, and on March 3, updated that timeline by announcing there will be enough vaccines for every adult by the end of May. As more people are vaccinated, it may reduce the pressures the virus placed on the real estate industry as hard-hit sectors can reopen and more people can return to work.

Workforce Rebound

The COVID-19 pandemic closed many businesses and weakened others, and as a result, companies were forced to make cost-cutting measures, including letting employees go. The unemployment rate soared to 14.7% in April 2020, just after the virus began spreading in the United States, according to Bureau of Labor Statistics. From March to April, the country lost more than 20 million net jobs and dropped from nearly 150.8 million workers to 130.2 million. However, since then, the unemployment rate has fallen to 6.2% in February 2021 as businesses have reopened and workers have steadily returned to the workforce. There are now more than 143 million employees in the workforce.

If new virus infections continue to shrink, the expectation is that businesses will be able to return to normal and the workforce will continue its rebound. This bodes well for commercial real estate, because the rents from tenants provide the main revenue stream for buildings. Rent collections for multifamily properties have held up during the pandemic helped by federal relief aid, but with the return of businesses and employers, demand for housing could return to the hardest hit markets, while rents should continue to grow in markets that were the beneficiaries of large relocations during COVID-19.

More Stimulus Aid Is Coming

The new administration made an additional round of COVID-19 stimulus aid one of its top priorities of its first 100 days, and announced the $1.9 trillion American Rescue Plan in January. The House of Representatives passed a package based on the White House’s proposal on Feb. 27, and the legislation passed in the Senate with changes on March 6. It will become the third COVID-19 stimulus package if it receives final approval from the House and is signed into law by the president. Multifamily has been bolstered by federal relief aid from the pandemic and this round is not likely to be any different. The funds will help individuals meet their financial obligations, such as rents and utilities. In addition to stimulus checks, the bill includes $30 billion for rental assistance, which could be a boost to the multifamily real estate industry.

Rising Inflation

Inflation is the rise in prices for goods and services over time. As inflation rises, the purchasing power of currency decreases, eroding the value of investors’ money. However, a modest increase in inflation is seen as a good thing for an economy because it makes more people spend money faster as they would prefer to do so before their money loses further value. More spending gives a boost to businesses, which can create more jobs and ultimately could lead to economic growth.

The Federal Reserve typically aims for 2% annual inflation growth. However, since the COVID-19 pandemic, inflation has been much lower, and the Fed changed its policy to allow inflation to rise above 2% temporarily, signaling that it’ll keep interest rates low. Certain assets have the ability to act as a hedge against inflation. Real estate is such an investment because during inflationary periods, rents tend to rise and property values appreciate, outpacing inflation, while long-term, fixed-rate mortgages simultaneously keep debt payments stable.

Conclusion

Commercial real estate markets were shaken by the COVID-19 pandemic in 2020, but with the rollout of the vaccines, the tide appears to be turning and demand is likely to return to the industry as cases continue to decline in 2021. Commercial real estate can avoid wild stock market speculation, can be a hedge against potential inflation, and can benefit from businesses reopening and additional stimulus aid from the federal government — all of which make it attractive in 2021.